Sep 23, 2023 | Miscellaneous, The Issues

On Sept. 25 Council agenda there is a staff report recommending approval of several actions to support maintenance of the Eversley Church on Dufferin St. The actions include approval of a heritage permit, awarding heritage grants. As explained in the report one...

Jun 11, 2023 | Miscellaneous, The Issues, Uncategorized

On June 15 Council agenda there is a report regarding the clean out of culverts and channels (one in Kingscross and one in Nobleton). The report is seeking approval to single source without a RFP with TRCA. As reviewed there is good reason for this procurement...

Jun 10, 2023 | Debbie in the Community, Miscellaneous, The Issues, Uncategorized

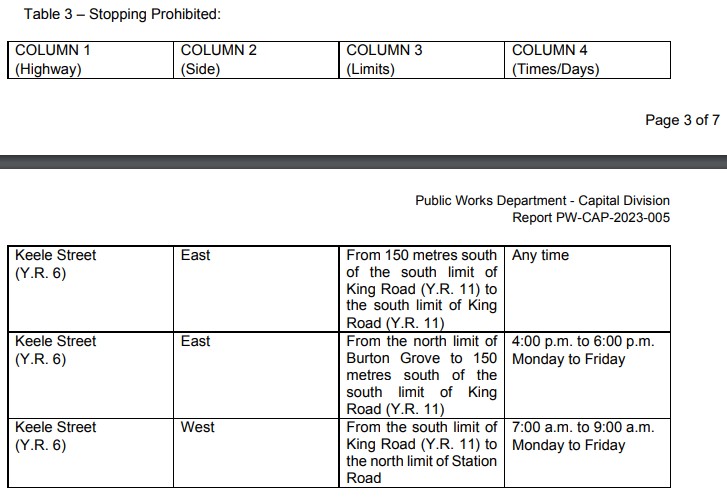

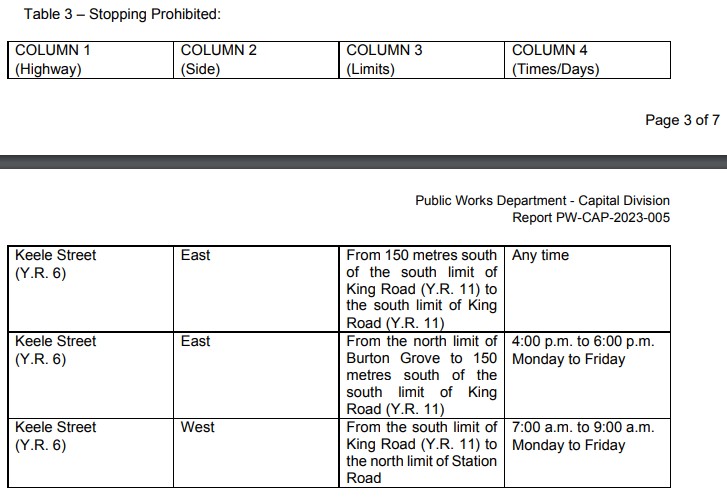

On June 15 council agenda there is a staff report including recommendations for improving traffic flow at Keele/King Road by regulating parking and for uploading two road segments to York region. Addressing the intersection congestion is long overdue. I think the...

Jun 6, 2023 | Miscellaneous, The Issues

To help close the digital divide and provide access to high-speed internet to every corner of the Region, YorkNet is embarking on a large-scale Expansion Project. To help support the Project, YorkNet applied for and received funding from the federal and provincial...

May 28, 2023 | Policies, Masterplans, The Issues

At May 29 Council meeting there will be a presentation on the proposed corporate strategic plan for 2023-2026. As reviewed in the report on same which will be discussed following the presentation there has been a significant amount of prepartory work. I think the...

May 28, 2023 | The Issues, Transportation

On May 29 Council agenda there is a report for amending a bylaw to enable the installation of new stop signs. Of particular interest to Ward 5 residents is the installation of all way stop signs at Burns & Station Road and Burns & Robert Berry Crescent. ...