This new funding source is required to finance the maintenance and improvement works on the Township’s stormwater infrastructure in response to aging assets, provincial regulations and the effects of climate change.

This new funding source is required to finance the maintenance and improvement works on the Township’s stormwater infrastructure in response to aging assets, provincial regulations and the effects of climate change.

To date King has not had a separate storm water rate line item on the property tax bill as it was incorporated into the Public Works budget.

To learn about the proposed rates visit speaking@king.ca. As you will see there are different rates for different property classifications.

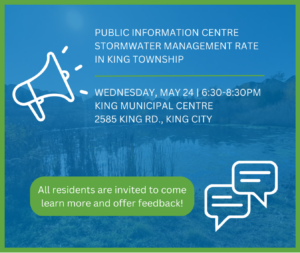

Wednesday, May 24 6:30-8:30 PM at the Municipal Centre

The reality is that infrastructure is the responsibility of the user. Between the water in and out rate, this new tax proposal will discourage new housing growth. Not because of the province’s appetite for growth but the fact the consumer will be discouraged by the growth of “unaffordable “ factors in wanting to move to King Township. One wonders if we provided for more permeable surfaces like parks, protecting natural marshes and wetlands, encourage less sidewalks and support naturalized lawns and driveways would we need man-made storm water ponds, culverts and ditches.

I agree with your latter points about how our propensity to build more/wider roads and hardscape our properties as opposed to lawns and gardens and permeable surfaces contributes to our need for stormwater management. I will be asking staff if its possible to incorporate the choices made to eliminate permeable surfaces such that those choices influence the magnitude of a rate on a specific property; I say this recognizing that it will not be easily done given the need for the data to be collected. In addition to the choices property owners make there is also the impact of intensification and the new policies under Bill 23 permitting >1 house per lot. Finally, I agree that this is going to raise property taxes; whether that will discourage growth I don’t know.

Debbie: I apologize that I will not be able to attend this evening. Regarding this new tax. Should homes be rated based on permeable surface area rather than value. How is it fair to enable a farm which has well & septic differently to Houses on lots which have surface area of their yards to absorb storm water & allow recharge. Should the math on rates be dependent on built surface rather than property value?

I don’t know if doing it solely on built surface would be “right” I do think that it should be one of the factors considered. I would like to see a connection between the rate and the choices property owners make about their properties. As you can’t attend the PIC please submit your comments on speaking@king.ca

Debbie: Property tax rate is a blunt instrument on which to determine a stormwater tax. Not all $1m homes sit on the same lot sizes & there are n’t many $1m homes in King City. It would be more reflective if the calculations for King City looked at $2 & $3m homes as a basis for indicating how much tax will be charged. I don’t think I should pay any more $ than a farm. Why should I pay the same as a house which is valued similarly albeit that house sits on a postage stamp lot e.g., those near the station where water does not drain effectively & pools on the hard surfaces of the trails? I have natural drainage & recharge like a farm for which I am grateful.

I believe the brief synopsis of the proposed rate on speaking@king.ca is not very well articulated. The proposed rate for a $1m home of $95.83 is for a property with a $1m MPAC assessment; if the assessment is $3m the stormwater rate will be 3 x $95.83. The rationale for farmland stormwater rate which is showing to be 25% of the $1m residential property is that farmland is taxed at 25% rate of residential properties. I have suggested that the wording should be improved.

The proposal to have all property owners pay the stormwater rate is comparable to having everyone pay for the library system.

I encourage you submit comments to speaking@king.ca.

Debbie I have to say I have a hard time with this one As you know I have personal experience with how the town deals with storm water management . Town staff allowed a neighbour to grade their property They were allowed the cheap solution to grade everything to the supposed swail between our properties and the culvert by the road instead of to the natural pond and run off they had on their own property. Net result is there is now a water problem too much water artificially directed to the “system” instead of using the natural features that were purposefully kept when Kingscross was developed . Outside of culverts there is NO storm water management system maintained by the town in our neighbourhood. Our natural ponds wetlands and streams which homeowners maintain themselves are our “storm water management system”. Is the town going to take over responsibility for the natural system of ponds and streams. Or is this another tax ratepayers in kingcross will pay with little return from the town. Again no sidewalks, curbs, streetlights, water, sewage or now storm water management system; as was stated previously the town uses the blunt instrument of property tax when services are not uniform . There has got to be a better way to implement this requirement

Hello Mike I understand your perspective. Having said that it seems to me inevitable that whenever there is a collection of property owners which are managed & serviced together there will be services which individual property owners fund even though they are not users. I guess there is one exception (i.e. where non users don’t pay for services not used): water. Recipients of water services pay for it and the fee includes both maintenance and building reserves to fund replacement.

The last words of your post is important: “this requirement.” The explanatory boards shown last night will be posted on speaking@king.ca. One of them shows the trajectory of our ability to effectively manage our stormwater assets given current budget. Without this new rate we are heading to a huge deficit unless the municipality were to decide to not fulfill its obligations on this service.

I will close my response with comment that it is worth noting that many municipalities in York Region have had a stormwater management tax for several years.

I encourage you submit comments to speaking@king.ca

Unfortunately, I come to this discussion late due to absence. This is a tax grab by another name. I understand that storm water management is required and very likely has been neglected in King Township, as have roads. But to tie the rate to property value is patently unfair. As other writers have stated, rural properties, and there are a great many, do not have storm sewers because their properties provide natural run-off. Such properties are likely to be assessed a higher value by MPAC due to their size. The Township does nothing to maintain natural run-off pathways. I am even having trouble to have a swail on township property to be cleared of dead weed trees that have been allowed to grow unchecked and impeding normal storm water run-off.

I am not proposing to exempt property owners with natural storm water management from paying a management fee. Storm water management benefits all Township residents equally like other infrastructure such as roads, for instance. Are you next going to introduce a road maintenance tax based on property value? Of course not, because there is no connection between property assessment and road use. Any infrastructure tax must be a flat rate for everyone regardless of property value.

Hello Uli,

thank you for your comments. I particularly appreciate that you made a suggestion for a different manner for getting the needed money to support getting the work done. For me it is legitimate that it is a separate line item, rather than simply being “buried” in the budget, as is roads, for the first couple years; it makes it very clear to the tax payer that it is new and that it is being directed specifically at that work. But I don’t really follow your point about roads…the amount each tax payer contributes to road maintenance is based on the MPAC assessment. The tax rate is determined by the budget which says that $XX required to deliver the desired services for the upcoming year; how much each tax payer pays is the tax rate factored against the MPAC.

You say there is a swale requiring cleaning. Please send the info re location etc to serviceking@king.ca. They will send it on to public works